The Seychelles is well known globally for its welcoming business atmosphere providing benefits for growing companies. Thanks, to its low taxes businesses can keep a substantial share of their earnings whether they are earned or kept in bank accounts. Delve into the details of Seychelles company formation below.

To unlock these perks and additional advantages the first thing you need to do is sign up your company. This detailed manual will lead you through the steps of establishing a Seychelles based company with the guidance of professionals, from ICD Fiduciaries.

Seychelles: A Snapshot

Seychelles is made up of a group of 115 islands located in the Indian Ocean positioned to the east of mainland Africa with Madagascar as its nearest neighbor.

The country’s economy mainly relies on tourism, fishing and processing products such as vanilla and coconuts. The government is the employer and plays a significant role in generating revenue.

Since gaining independence from Britain in 1976 Seychelles has seen growth in GDP per capita largely driven by government investments in the tourism industry.

In 2018 Seychelles had a GDP of $1.583 billion with a growth rate of 4.1%, slightly lower, than the previous years 4.3%. Key figures relevant to Seychelles company formation include:

- Annual exports totaling approximately $564 million, with canned tuna, petroleum products, and frozen dishes comprising the majority.

- Annual imports averaging $1.55 billion, including machinery, foodstuffs, equipment, petroleum products, and processed goods.

- Key import partners include the United Arab Emirates, France, Spain, and South Africa.

- With the passing of the Insurance Act 2007 and Mutual Fund Act 2007, Seychelles has emerged as one of the fastest-growing offshore financial centers.

- The country has also become a focal point for offshore oil and gas exploration, spurred by the discovery of potentially vast offshore petroleum reservoirs.

Seychelles Company Formation: Why Choose Seychelles?

When deciding whether to start a business, in your country or explore investments abroad Seychelles presents many attractive advantages that make it a top choice among various jurisdictions.

Privacy Is a Paramount Concern for Investors, Particularly Those Exploring Offshore Opportunities

After putting in a lot of work into their professions or businesses people should be able to trust that their assets will be kept safe with the highest level of confidentiality. Seychelles provides an answer by ensuring full privacy through legal means.

Apart, from the identity and personal details of the company director all other information, including that of directors and beneficial owners is kept private in the Seychelles company register. This indicates that regardless of where you come from Seychelles values and safeguards your privacy.

Equitable Taxation System

Setting up a business in Seychelles comes with an advantage of its fair tax system. The region follows a Territorial Tax System, where earnings made outside the nation are not taxed all. Seychelles has zero taxes on capital gains stamp duties, interests and commercial dealings making it a desirable choice, for investors.

Seychelles Offers a Flexible Business Structure

Seychelles has introduced a business framework to boost growth and encourage investor engagement. This flexibility is reflected in the options to investors, such, as setting up an International Business Company (IBC) with just one shareholder and director who can be the same person.

Furthermore, IBCs that maintain proper accounting records are exempt from mandatory tax filings, alleviating concerns about costly audit procedures. It’s important to note that this exemption applies solely to IBCs without local operations in Seychelles.

Furthermore businesses incorporated in Seychelles are not required to hold general gatherings on the island. This removes the necessity for travel plans, for shareholders as discussions can take place through video or phone calls.

Seychelles Offers Premier Banking Services Worldwide

Seychelles boasts some of the finest banking facilities globally, ensuring top-tier services for your business endeavors. For international business companies, having a bank account in Seychelles is a prerequisite to commence operations post-company formation.

A lot of investors prefer banking because it offers improved security, speed and dependability. Another benefit of enrolling your company in the Seychelles business registry is that you don’t have to go to the island to set up a bank account. So whether you’re an investor, from the US, Canada, UK or any other nation you can start the account registration process from the comfort of your country. Additionally, Seychelles imposes no restrictions on nationality when it comes to opening bank accounts.

Political and Economic Stability

A country’s economic stability directly influences the future success of businesses within its borders. Seychelles demonstrates robust economic growth, presenting an excellent opportunity for growth and development.

With a democratic economy, Seychelles has maintained remarkable stability, allowing businesses to plan effectively for growth and asset management on the island. This stability ensures a conducive environment for companies to thrive and prosper.

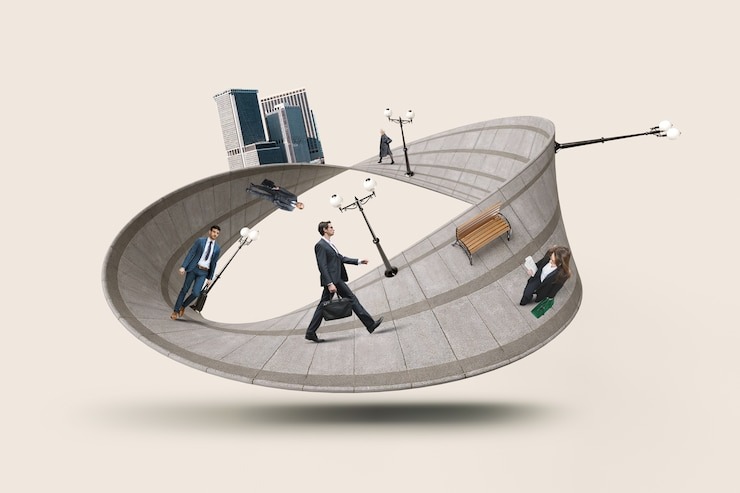

Registering a Company in Seychelles Remotely

Unlike in countries, around the world where setting up a business requires significant travel Seychelles provides a distinct benefit: the opportunity to establish a company without having to visit the island in person. This convenient feature is facilitated by agencies that help investors with remote company registration. There are several benefits to this approach:

- Professional Document Preparation: Expert firms ensure that all the required paperwork is professionally handled, saving investors time and effort.

- Streamlined Registration Procedure: With the help of these firms the process of registering a business in Seychelles is fast tracked allowing investors to kickstart their ventures promptly.

- Prioritize Tasks: By entrusting the registration process to a firm investors can shift their attention to essential activities like securing additional funding or implementing marketing campaigns.

- Strategic Advice: Seasoned firms offer insights and advice to investors aiding them in crafting effective market entry strategies, for rapid business expansion.

Types of Companies Available for Seychelles Company Formation

When you’re setting up your business in the Seychelles company registry it’s important to choose the company type that best fits your investment goals. Luckily Seychelles offers a range of company structures to pick from such as:

- Special License Companies (CSL): These entities are mainly used for carrying out business activities in Seychelles.

- Proprietary Companies: Similar to liability companies proprietary companies restrict your liability to the extent of your ownership in the company.

- Trusts: Many investors prefer trusts when starting businesses, in Seychelles for safeguarding assets.