Being self-employed is a way of life for many people. It comes with great advantages. Being your own boss truly does feel great. You’re in charge; you make all the decisions; and most importantly no one can tell you what to do. In today’s age being self-employed is easier than ever. It is no wonder many people decide to live this life. Money is good too. All of this depends on your branch of operations. In essence, there are many benefits and advantages of self-employment, but there are a few flaws too.

Nothing is perfect. The biggest issue that self-employed individuals have is taxes. Depending on the size of your operations and income, you might hire an accountant. But, most self-employed individuals need to do taxes by themselves. This is a stressful situation. Taxes are no joke. Navigating through the universe of self-employment and tax issues can be difficult. If you don’t know what you’re doing, soon enough, you might find yourself in trouble with the tax administration agency. That’s why you should consider finding help. If you want to get straight down to work seeking assistance from outlets such as PaycheckGuru which provides a tax calculator might be a wise decision.

As we said, taxes are no joke. They shouldn’t be neglected. You might be an expert at what you do, but if you mess up taxes it’s possible you could find yourself on the wrong side of the law in no time. Being self-employed is amazing, but don’t forget the small matter of taxes. We haven’t. That’s why we will share these tips for a stress-free experience with taxes. Be a little patient, read this article, and see what we have to offer.

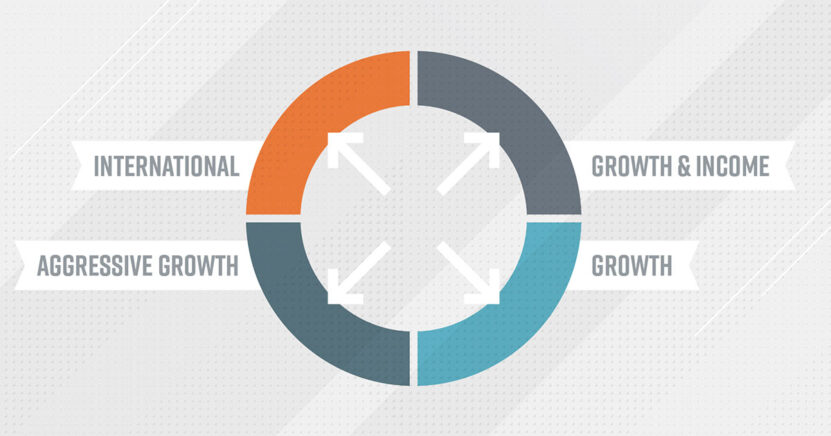

Diversify Your Accounts

Let’s start here. While you’re self-employed, you need to see yourself as two entities. You have business finances and your personal ones. Have separate accounts for the business and your personal operations. This is important so that you would know what should be taxed, which assets belong where, and to have a better view of all of your items tied to bank accounts. Having separate accounts helps vastly with the organization. When it comes to money and taxes you want to have a good look at the flow, and you want everything in order. Nice and tidy. This will make matters easier for both your accountant and the authorities. Not to mention your piece of mind. Keep accounts separated. It is a great place to start in order not to get too stressed with taxes.

Focus on Income Accuracy

When you’re self-employed your income will go through your accounts. Keep a record of all of it. This is vital. You must report income to tax authorities. Precision matters in this domain. You mustn’t miss payments you receive. As a self-employed person, your income will not be coming from only one side. Instead, you’ll have multiple clients, gigs, and projects. All of them will generate income. It will be easy to lose track of who paid for what, and which money came from where. Focus on all payments. Document everything. This will be of great help when the tax season comes knocking on the door. In this department, it is possible to use designated software. Also, your bank will keep a record of this. So, seek their help when you want to know about your money flow. Of course, today it is possible to know all of this on the bank’s mobile app. Ensure the following income flow on a regular basis, as you’ll never know when you’ll need this data on short notice.

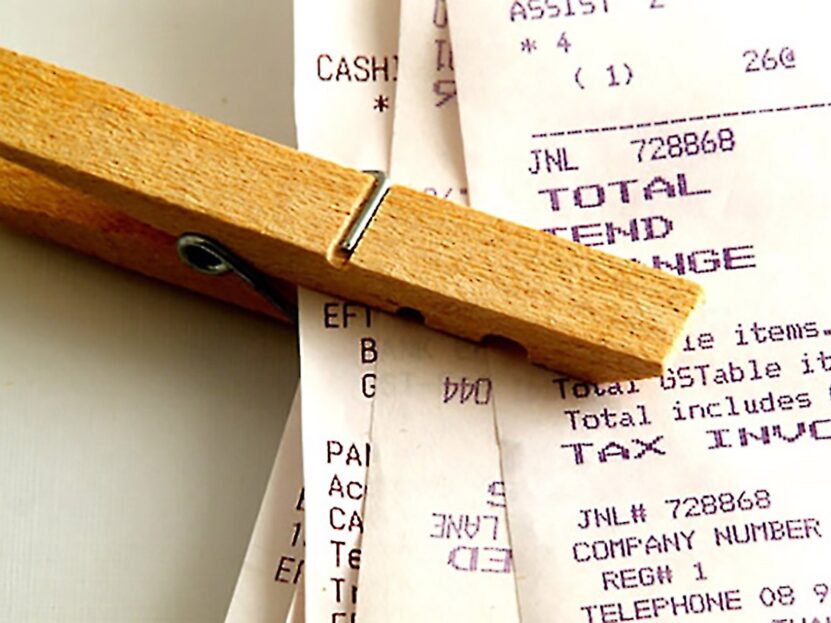

Save All Receipts

In the same way, you must have an eye on your income, it is important to be focused on your expenditure. The best way to do this is to save all of your receipts and payments. Most payments these days can be done online and people tend to exploit this benefit of modern technology. But, it also makes it hard to preserve physical copies of everything you spend. But, you have to do it nonetheless. So, keep a record of electronic payments, and all other expenditures, and save receipts of every transaction you had. If you do this, when the day comes to handle your taxes you’ll have one less thing to worry about.

Don’t Forget to Save Money

It is easy to get on spending free when you’re self-employed. Money keeps flowing, you have only yourself to worry about, and it feels sometimes as if no one controls you. You must control yourself. Save money. This will help you greatly when it comes to taxes. It is hard to follow income and expenditure down to every penny. The amount of taxes that you’ll be due when the time is right might be much more than you anticipated. This is why you must always have money on the side. Being self-employed means that no one pays for your FICA taxes. You need to do it yourself. The easiest way to go around paying taxes is to have more money prepared on the side than you require for your tax obligations. Easier said than done, but when you’re self-employed saving and leaving money on the side is a must.

Make Quarterly Payments

This is how you should approach your taxes. Yes, you can pay taxes all at once. It is possible to do this every year. But, to avoid negative surprises you’d have to put a lot of money on the side and chunk a massive sum when the year is due. To avoid getting into trouble and having fewer funds than required you must approach your taxes quarterly. This is the ideal way to keep the tax situation under control and avoid paying penalties. If you want to do this properly you can seek help from the IRS. On their website, you’ll find all the help you need. They even have a section dedicated to self-employed people. Get all the help you can. But, make sure that your taxes are done on time. The best way to do it is to focus on it every three months.